Start or restart your Metatrader Client. Select Chart and Timeframe where you want to test your forex system. Right click on your trading chart and hover on “Template”. Move right to select Fake Out Forex Trading Strategy. You will see Fake Out Forex Trading Strategy is available on your Chart 4/19/ · Partner Center Find a Broker. In order to fade breakout s, you need to know where potential fakeouts can occur. Potential fakeouts are usually found at support and resistance levels created through trend lines, chart patterns, or previous daily highs or lows 9/27/ · What are false breakouts in forex trading. A false breakout/fake out is simply a failed breakout. Just like breakouts, fake outs also normally occur on support and resistance levels, trend lines, Fibonacci retracements, channels and chart patterns. Price normally breaks and then suddenly reverses direction after a break

How to Trade Fakeouts in Forex - blogger.com

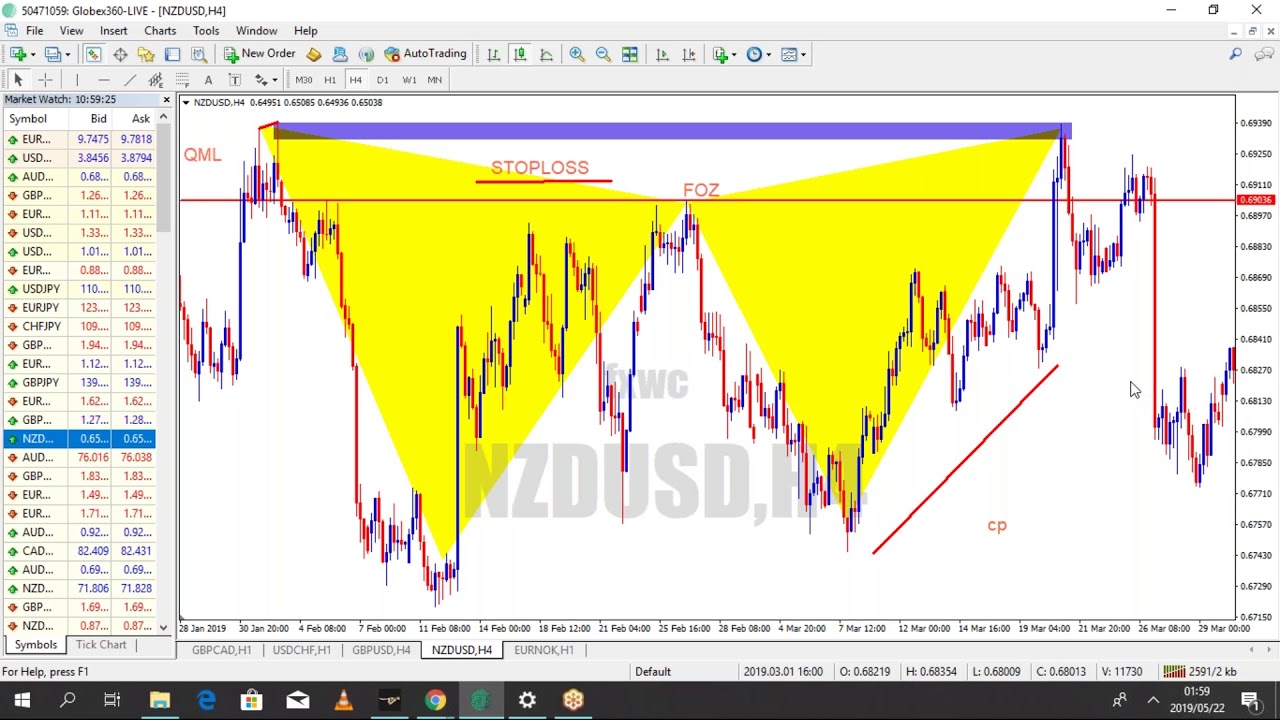

In order to fade breakout s, you need to know where potential fakeouts can occur. Potential fakeouts are usually found at support and resistance levels created through trend lines, forex fake out, chart patternsor previous daily highs or lows.

In fading breakouts, always remember that there should be SPACE between the trend line and price, forex fake out.

If there is a gap between the trend line and price, it means the price is heading more in the direction of the trend and away from the trend line. Like in the example below, having space between the trend line and price allows the price forex fake out retrace back towards the trend line, perhaps even breaking it, and provide fading opportunities.

If the price is inching like a caterpillar towards the trend linea false breakout may be likely. However, a fast price movement towards the trend line could prove to be a successful breakout. This will allow you to take the safe route and avoid jumping the gun.

Chart patterns are physical groupings of the price you can actually see with your own eyes. They are an important part of technical analysis and also help you in your decision-making process. The head and shoulders chart pattern is actually one of the forex fake out patterns for new traders to spot. However, with forex fake out and experience, this pattern can become an instrumental part of your trading arsenal.

The head and shoulders pattern is considered a reversal. If formed at the end of an uptrend, it could signal a bearish reversal. Conversely, if it is formed at the end of a downtrendit could signal a bullish reversal. Head and shoulders are known for generating fakeouts false breakouts and creating perfect opportunities for fading breakouts.

False breakouts are common with this pattern because many traders who have noticed this formation usually put their stop loss very near the neckline, forex fake out. Traders who have sold the downside breakout or who have bought the upside breakout will have their stops triggered when prices move against their positions.

This usually is caused by the institutional traders who want to scrape money from the hands of individual traders. You can fade the breakout with a limit order back in the neckline and just put your stop above the high of the fakeout candle.

You could place your target a little below the high forex fake out the second shoulder or a little above the low of the second shoulder of the inverse pattern. Traders just love these patterns! Why do you ask? Because of this, plenty of traders place their entry orders very near the neckline in case of a reversal.

The problem with these chart patterns is that countless traders know them and place orders at similar positions. Similar to the head and shoulders pattern, you can place your order once the price goes forex fake out in to catch the bounce. You can set your stops just beyond the fakeout candle. The best results tend to occur in a range-bound market. However, you cannot ignore market sentimentmajor news events, common sense, and other types of market analysis.

Financial markets spend a lot of time bouncing back and forth between a range of prices and do not deviate much from these highs and lows. Ranges are bound by a support level and a resistance level, forex fake out, and buyers and forex fake out continually push prices up and down within those levels.

Fading the breakouts in these r ange-bound environments can prove to be very profitable. However, at some point, one side is eventually going to take over and a new trending stage will form. Partner Center Find a Broker. Next Lesson Summary: Trading Breakouts and Fakeouts, forex fake out. To hell with circumstances; I create opportunities, forex fake out. Bruce Lee.

Mastering fakeouts - How to trade false breakouts!

, time: 17:27- The Forex Fakeout Trader - Trading Platform for Beginners and Advanced Traders

1/26/ · What are False Breakouts in Forex? False Breakouts are occurrences on the chart when the price breaks an obvious level, but then suddenly changes direction. When the initial breakout happens, many traders are lured into the trade by entering the market in the direction of the breakout As all Forex traders know, these patterns form often. Spotting a Fakeout with the Fakey Candlestick Pattern. In Forex trading, the market looks for tripping stops. Most of the times, it trips the stops and then reverses. The fakey candlestick pattern is designed to spot false breakout Forex patterns Fakeouts basically happen because the forex market is extremely liquid, and while some people will give a lot of weight to certain support and resistance levels, others will not, and hence the market will move in unpredictable ways

No comments:

Post a Comment