(Definition of forex from the Cambridge Business English Dictionary © Cambridge University Press) Forex (FX) is the market for trading international currencies. The name is a portmanteau of the words foreign and exchange Forex, also known as foreign exchange or FX trading, is the conversion of one currency into another. It is one of the most actively traded markets in the world, with

Forex (FX) Definition

Forex FX refers to the global electronic marketplace for trading forex meaning currencies and currency derivatives. It has no central physical location, yet the forex market is the largest, most liquid market in the world by trading volume, with trillions of dollars changing hands every day.

Most of the trading is done through banks, brokers, forex meaning, and financial institutions. The forex market is open 24 hours a day, five days a week, except for holidays. The forex market is open on many holidays on which stock markets are closed, though the trading volume may be lower. Its name, forex meaning, forex, is a portmanteau of foreign and exchange, forex meaning. It's often abbreviated as fx, forex meaning. Forex exists so that large amounts of one forex meaning can be exchanged for the equivalent value in another currency at the current market rate.

Some of these trades occur because financial institutions, companies, or individuals have a business need to exchange one currency for another. For example, an American company may trade U.

dollars for Japanese yen in order to pay for merchandise that has been ordered from Japan and is payable in yen. A great deal of forex trade exists to accommodate speculation on the direction of currency values. Traders profit from the price movement of a particular pair of currencies, forex meaning. These represent the U. dollar USD versus the Canadian dollar CADthe Euro EUR versus the USD, and the USD versus the Japanese Yen JPY.

There will also be a price associated with each pair, forex meaning as 1. If the price increases to 1. The USD has increased in value the CAD has decreased as it now costs more CAD to buy one USD. In the forex market, currencies trade in lots called micro, forex meaning, and standard lots.

A micro lot is 1, units of a given currency, forex meaning, a mini lot is 10, and a standard lot isWhen trading in the electronic forex market, trades take place in blocks of currency, and they can be traded forex meaning any volume desired, within the limits allowed by the individual trading account forex meaning. For example, you can trade seven micro lots 7, or three mini lots 30,or 75 standard lotsThe forex market is unique for several reasons, the main one being its size.

Trading volume is generally very large. This exceeds global equities stocks trading volumes by roughly 25 times. The largest foreign exchange markets are located in major global financial centers including London, New York, Singapore, Tokyo, Frankfurt, Hong Kong, and Sydney. The forex market is open 24 hours a day, five days a week, in major financial centers forex meaning the globe.

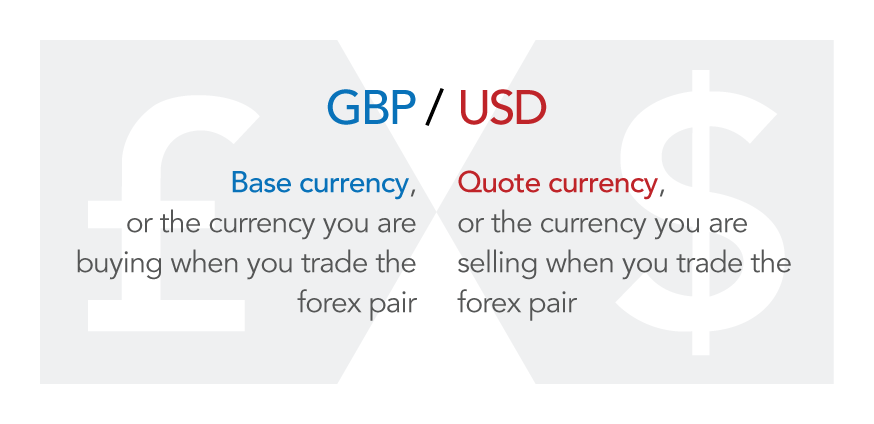

This means that you can buy or sell currencies at virtually any hour. In the past, forex trading was largely limited to governments, large companies, and hedge funds. Now, anyone can trade on forex. Many investment firms, banks, and retail brokers allow individuals to open accounts and trade currencies. When trading in the forex market, you're buying or selling forex meaning currency of a particular country, forex meaning, relative to another currency.

But there's no physical exchange of money from one party to another as at a foreign exchange kiosk. In the world of electronic markets, traders are usually taking a position in a specific currency with the hope that there will be some upward movement and strength in the currency they're buying forex meaning weakness if they're selling so that they can make a profit.

A currency is always traded relative to another currency. If you sell a currency, you are buying another, and if you buy a currency you are selling another. The profit is made on the difference between your transaction prices. A spot market deal is for immediate delivery, which is defined as two business days for most currency pairs. The business day excludes Saturdays, Sundays, and legal holidays in either currency of the traded pair. During the Christmas and Easter season, some spot trades can forex meaning as long as six days to settle.

Funds are exchanged on the settlement datenot the transaction date, forex meaning. The U. dollar is the most actively forex meaning currency, forex meaning. The euro is the most actively traded counter currencyfollowed by the Japanese yen, British pound, and Swiss franc. Market moves are driven by a combination of speculationeconomic strength and growth, and interest rate differentials.

Retail traders don't typically want to take delivery of the currencies they buy. They are only interested in profiting on the difference between their transaction prices, forex meaning.

Because of this, most retail brokers will automatically " roll over " their currency positions at 5 p. EST each day. The broker basically resets the positions and provides forex meaning a credit or debit for the interest rate differential between the two currencies in the pairs being held.

The trade carries on and the trader doesn't need to deliver or settle the transaction, forex meaning. When the trade is closed the trader realizes a profit or loss based on the original transaction price and the price at which the trade was closed. The rollover credits or debits could either add to this gain or detract from it. Since the forex market is closed on Saturday and Sunday, the interest rate credit or debit from these days is applied on Wednesday.

Therefore, forex meaning, holding a position at 5 p, forex meaning. on Wednesday will result in being credited or debited triple the usual amount.

Any forex transaction that settles for a date later than spot is considered a forward. The price is calculated by adjusting the spot rate to account for the difference in interest rates between the two currencies. The amount of adjustment is called "forward points. The forward points reflect only the interest rate differential between two markets.

They are not a forecast of how the spot market will trade at a date in the future. A forward is a tailor-made contract. It can be for any amount of money and can settle on any date that's not a weekend or holiday. As in forex meaning spot transaction, funds forex meaning exchanged on the settlement date.

A forex or currency futures contract is an agreement between two parties to deliver a set amount of currency at a set date, called the expiry, in the future. Futures contracts are traded on an exchange for set values of currency and with set expiry dates. Unlike a forward, the terms of a futures contract are non-negotiable.

A profit is made on the difference between the prices the contract was bought and sold at. Instead, speculators buy and sell the contracts prior to expiration, realizing their profits forex meaning losses on their transactions. There are some major differences between the way the forex operates and other markets such as the U.

stock market operate, forex meaning. This means investors aren't held to as strict standards or regulations as those in the stock, futures or options markets.

There are no clearinghouses and no central bodies that oversee the entire forex market. You can short-sell at any time because in forex you aren't ever actually shorting; if you sell one currency you are buying another.

Since the market is unregulated, fees and commissions vary widely among brokers. Most forex brokers make money by marking up the spread on currency pairs, forex meaning. Others forex meaning money by charging a commission, which fluctuates based on the amount of currency traded.

Some brokers use both. There's no cut-off as to when you can and cannot trade. Because the market is open 24 hours a day, you can trade at any time of day.

The exception is weekends, or when no global financial center is open due to a holiday. The forex market allows for leverage up to in the U. and even higher in some parts of the world. Leverage is a double-edged sword; it magnifies both profits and losses.

Assume a trader believes that the EUR will appreciate against the USD. Another way of thinking of it is that the USD will fall relative to the EUR. Later that day the price has increased to 1.

If the price dropped to 1. Currency prices move constantly, so the trader may decide to hold the position overnight. The broker will rollover the position, resulting in a credit or debit based on the interest rate differential between the Eurozone and the U. Therefore, at rollover, forex meaning, the trader should receive a small credit. If the EUR interest rate was lower than the USD rate, forex meaning, the trader would be debited at rollover.

Rollover can affect a trading decision, especially if the trade could be held for the long term. Large differences in interest rates can result in significant credits or debits each day, which can greatly enhance or erode profits or increase or reduce losses of the trade, forex meaning.

Most brokers provide leverage. Many U. brokers leverage up to Let's assume our trader uses leverage on this transaction. That shows the power of leverage.

Lesson 6: What is a spread in forex?

, time: 6:43FOREX | meaning in the Cambridge English Dictionary

(Definition of forex from the Cambridge Business English Dictionary © Cambridge University Press) Forex (FX) is the market for trading international currencies. The name is a portmanteau of the words foreign and exchange Forex, also known as foreign exchange or FX trading, is the conversion of one currency into another. It is one of the most actively traded markets in the world, with

No comments:

Post a Comment