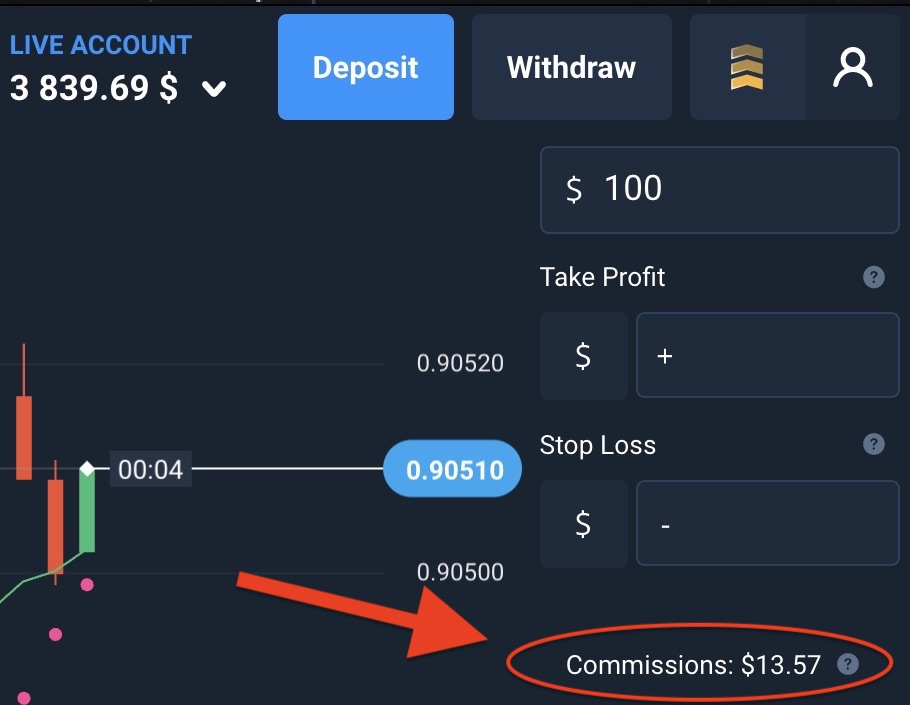

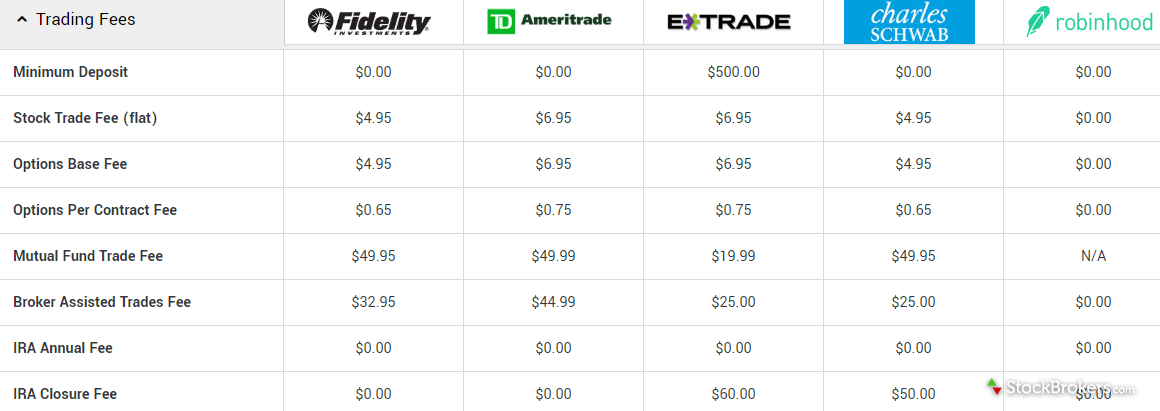

They are the best and cheapest on the market. With over 9 years of experience in Forex Trading, we have compared a total of hundreds of providers. IQ Option, BDSwiss, and Etoro have the best forex trading conditions in the world. You can already trade from pips spread and pay a maximum commission of $ 3 02/05/ · Broker’s trading fees are relatively simple. Rather than charge a percentage fee on all Forex trades, blogger.com trading costs are incurred via the spread. It offers average spreads on the most popular forex pairs, but is less competitive for CFDs. Average spreads on blogger.com range between pips to blogger.comted Reading Time: 8 mins 10/05/ · A big advantage in favour of Forex trading vs stock trading is the superior leverage offered by Forex brokers. With leverage, a trader with a smaller amount of money can, potentially, earn a larger profit in Forex vs stocks profit. However, while profits can be much larger, losses can also be multiplied by the same amount, very blogger.comted Reading Time: 7 mins

Forex Trading vs. Stock Trading: What's the Difference?

He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered Market Technician CMT. He is also a member of Trading fees comparison forex stocks Association. For securities traders, two popular markets are the stock market and the foreign exchange forex market.

One of the biggest reasons some traders prefer the forex to the stock market is enhanced leverage capabilities. However, trading fees comparison forex stocks prefer the regulatory safeguards of the stock market. Below, we compare the differences between stock trading and forex trading.

In stock trading, traders with a margin account may use as much as leverage. There are also some qualifying requirements before you can do this. Not every investor is approved for a margin account, which is what you need to leverage in the stock market.

Forex trading is very different. To qualify to trade with leverage, you open a forex trading account. There are no qualifying requirements. The exact leverage limit depends on the brokerage, but many traders can expect to access as much as leverage. This is just one way in which forex markets are less regulated than stock markets.

For some, trading fees comparison forex stocks limits imposed by regulations may push them toward forex trading. Others see regulation as an extra layer of protection against fraud and wrongdoing, so trading fees comparison forex stocks may prefer to trade in that environment.

When you trade stocks, you buy shares trading fees comparison forex stocks companies that cost anywhere from a few dollars to hundreds trading fees comparison forex stocks dollars. Market price varies with supply and demand. Trading on the forex market is a different world. Although the supply of a country's currency can fluctuate, there is always a large amount of currency available to trade.

In consequence, trading fees comparison forex stocks, all major world currencies are highly liquid. This means the two markets have very different price sensitivity to trade activity. Stock purchase of 10, shares may impact the stock price. This effect is particularly powerful for smaller corporations with fewer shares outstanding, as opposed to giants like Apple, trading fees comparison forex stocks. In sharp contrast, forex trades of several hundred million dollars in a major currency will most likely have little—or no—impact on the currency's market price.

There is too much supply for any single transaction to have too much of an impact. In currency trading, currencies are always quoted in pairs. Not only do you have to be concerned with the economic health of the country whose currency you are trading, but you also have to consider the economic health of the country against which you are trading.

Does one country have more job growth than another, or better GDP, or political prospects? When you buy Intel shares, your primary concern is whether the stock will increase in value; you're less concerned with the stock prices of other companies. The only "pair" is the pairing between the stock price and the U. dollar if you're trading in the U. Forex markets sometimes exhibit greater sensitivity to emerging political and economic situations in other countries.

The U. stock trading fees comparison forex stocks isn't immune to political events, but it is usually less sensitive to geopolitical issues. Currency markets have greater access than stock markets. Traders who want to can trade stocks nearly 24 hours a day from Monday through Friday, but it isn't particularly easy to access all those markets. Most retail stock investors trade through a U. brokerage with one major trading period from a. to p. There is a much smaller "after-hours" trading market, but those hours typically have less liquidity and other issues that make them less popular than regular trading hours.

Forex trading, on the other hand, is much easier to do around the clock, Monday through Friday. There are many forex trading institutions worldwide, and it's always trading time in one time zone or another. Deciding which market to trade is largely a personal choice. Here are some factors to consider. The comparative freedom from regulation on the forex and its high degree of possible leveraging makes it easy to control large trades.

A beginning forex trader has many of the tools available to them that a seasoned trader has, whereas a stock trader needs to acquire special qualifications and save up a significant amount of capital to trade like the pros, trading fees comparison forex stocks. If you're eager to start trading large amounts of capital, forex trading is for you.

Stock trading can be easier to wrap your head around. While broader economic context always helps, buying a stock is a simple concept—you're buying a share of ownership in a company.

This, along with the highly regulated environment, can put some traders at ease and help them focus on their trading strategy. Short traders, however, trading fees comparison forex stocks, may find that stock trading actually carries more risk, as a result of how currency pairing works. When a stock market declines, you can make money by shorting, but this imposes extra risks. In forex trading, you can go short on a currency pair as easily as you can go long.

The two positions present similar risks. No additional precautionary trades to limit losses are necessary. One risk of shorting a stock, at least in theory, is that you may have unlimited losses. In reality, that's unlikely to happen because your broker will probably force you to end the short position. Nevertheless, most financial advisors caution against shorting for all, and many of the most experienced investors execute parallel stop-loss and limit orders to contain this risk.

Most investors are more familiar with the stock market than with forex, and that familiarity may be comforting. Whichever you choose, trade carefully and control your risk with stop-losses. Financial Industry Regulatory Authority. Securities and Exchange Commission. National Futures Association.

Accessed July 8, trading fees comparison forex stocks, Office of Investor Education and Advocacy. Trading Forex Trading. By John Russell Full Bio LinkedIn John Russell is an expert in domestic and foreign markets and forex trading. He has a background in management consulting, database administration, and website planning, trading fees comparison forex stocks.

Today, he is the owner and lead developer of development agency JSWeb Solutions, which provides custom web design and web hosting for small businesses and professionals. Learn about our editorial policies. Reviewed by Gordon Scott. Article Reviewed November 30, Learn about our Financial Review Board. Forex Trading Stock Trading Leverage Limits or more Liquidity Much larger supply, liquidity Less supply, liquidity Trade Pairing Any currency USD in the U.

Market Hours 24 hours per day, five days per week Most trading occurs between a, trading fees comparison forex stocks.

and 4 p. ESTMonday—Friday. Key Takeaways Forex trading is generally less regulated than stock trading, and forex traders have access to much more leverage than stock traders. Forex trading uses pairs, so the trade depends on the performance of two economies, as opposed to trading a single stock. Currencies are more liquid than stocks, they trade at all hours of the day, and large orders have less impact on currency pairings than they do on stock prices.

Article Sources.

Why I STOPPED Trading Forex And Switched To Indicies Full-Time (Best Decision I Ever Made)

, time: 9:28What does Forex Trading cost in ()? | Fees comparison

Trading Costs. Pricing, transparency and execution are key to any trading strategy. We are committed to giving you clear, flexible pricing solutions and exceptional trade execution. Choose your pricing with EUR/USD as low as with low commissions. Benefit from automatic price improvement on limit orders To compare the costs of trading at different brokers, our experts analyze both trading-specific fees, such as spreads, and non-trading fees, such as inactivity charges and payment costs. To give an overall view of how cheap or expensive AvaTrade and HFTrading are, we first considered the common fees on Standard Accounts 10/05/ · A big advantage in favour of Forex trading vs stock trading is the superior leverage offered by Forex brokers. With leverage, a trader with a smaller amount of money can, potentially, earn a larger profit in Forex vs stocks profit. However, while profits can be much larger, losses can also be multiplied by the same amount, very blogger.comted Reading Time: 7 mins

No comments:

Post a Comment